As businesses scale across borders, payment complexity scales with them. Delayed settlements, high FX fees, and fragmented banking infrastructure continue to slow down operations—especially in regions where traditional rails underperform.

TransFi's Global Payments stack changes that.

By integrating USDC, Circle Mint, and Programmable Wallets, TransFi delivers a real-time, stablecoin-powered payment infrastructure designed for global businesses.

Core Product Components

Real-Time Liquidity with Circle Mint

- TransFi directly integrates with Circle Mint to mint and redeem USDC on demand

- This ensures instant access to stablecoin liquidity during payout processing

- Eliminates wait times for bank settlements and liquidity delays in volatile markets

Programmable Wallets for Every Business Account

- Each business or sender is provisioned a dedicated USDC wallet using Circle’s programmable custodial infrastructure

- Balances are held securely, with full audit trails and transaction visibility

- TransFi ensures wallet-level compliance, custody delegation, and control management

Multi-Currency Payout Engine

- After USDC is funded into the wallet, TransFi enables instant payouts in 40+ local currencies

- Powered by a global payout partner network, including bank transfers, mobile money, and e-wallets

- Built-in logic determines the fastest, lowest-cost settlement route based on geography and method

Product Workflow: End-to-End Flow

1. Fiat or Crypto Top-Up

Businesses fund TransFi via fiat or crypto.

2. Minting USDC in Real Time

TransFi mints equivalent USDC using Circle Mint infrastructure.

3. Wallet Funding

USDC is deposited into a Programmable Wallet created in the client’s name.

4. Payout Execution

TransFi, based on user consent, triggers payouts in USDC or converts to fiat for final delivery using local partners.

5. Real-Time Reconciliation

Dashboard provides full visibility on balances, transfers, and settlements.

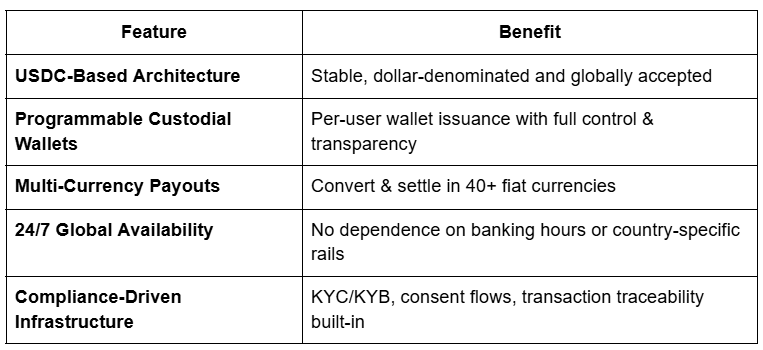

Product Highlights & Differentiators

Use Cases

Treasury Centralization

Manage all cash flows from a single USDC treasury across subsidiaries, partners, and geographies.

Payroll & Contractor Payouts

Pay teams in local currencies, even in hard-to-access markets, with a single USDC top-up.

Global Vendor Settlements

Instantly settle invoices using your stablecoin treasury, routed via compliant rails.

Dollar-Based Apps

Enable on-demand balance top-ups, withdrawals, and multi-currency exits through TransFi’s APIs.

Compliance & Control by Design

TransFi is built on a compliance-first framework:

- USDC is fully backed 1:1, with monthly public attestations

- Wallets are issued to each client, ensuring clear ownership

- Consent-based flows: Funds are only released upon explicit trigger

Client Impact Snapshot

A Global Payout Stack, Reinvented with Stablecoins

With Circle’s USDC infrastructure at its core, TransFi’s global payouts product offers an enterprise-grade stablecoin solution designed to replace outdated banking rails.

Businesses gain:

- Speed without sacrificing compliance

- Global reach without fragmented PSP setups

- Cost savings without operational complexity

This isn’t just an evolution of cross-border payments—it’s a completely redefined stack for the stablecoin era.

Table of Contents

Suggested Article

Explore our products

Make global payments at the speed of a click

Accept payments, remove borders.

Unlock Seamless Digital Currency Transactions Anywhere

.png)

.png)